If you’ve been thinking about whether to stay in your current home or make a move to a Life Plan Community, consider the costs you’ll incur from an aging home. There are two key factors of value and cost that could change your mind financially about staying where you’re at currently:

- The home itself has performed as a depreciating asset for several years.

- Even if the loans are paid off, some significant costs remain.

What’s Your Home Upkeep?

What’s Your Home Upkeep?

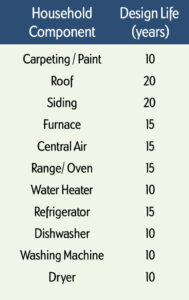

Do you know your monthly expenses? Have you considered additional costs related to home components that may need repaired or replaced over time? Review this chart and consider the components in your home that are approaching the design life/replacement timeframe. These expenses could add up quickly if they suddenly all need replaced in a short timeframe.

Are You Relying on Consistent Costs?

As gas, utilities and food prices rise among other necessities, how can you stabilize your expenditures to protect your retirement savings? Why not consider a home with fixed costs and amenities? At a Life Plan Community like SpiriTrust Lutheran®, you can avoid budget surprises and with that predictability you can free up disposable income for travel, a new hobby or other retirement dreams. For some people, maintenance-free living at a Life Plan Community is more affordable than staying at home.

Add it All Up!

Compare how staying in your own home adds up versus making a move to a newly renovated home for your retirement years. The smart financial plans at a SpiriTrust Lutheran® Life Plan Community can provide you with great value. While you “shop around” for a community, use this downloadable checklist and judge for yourself!